Our Steps to Financial Success

You have dreams, and we have the tools to get you there.

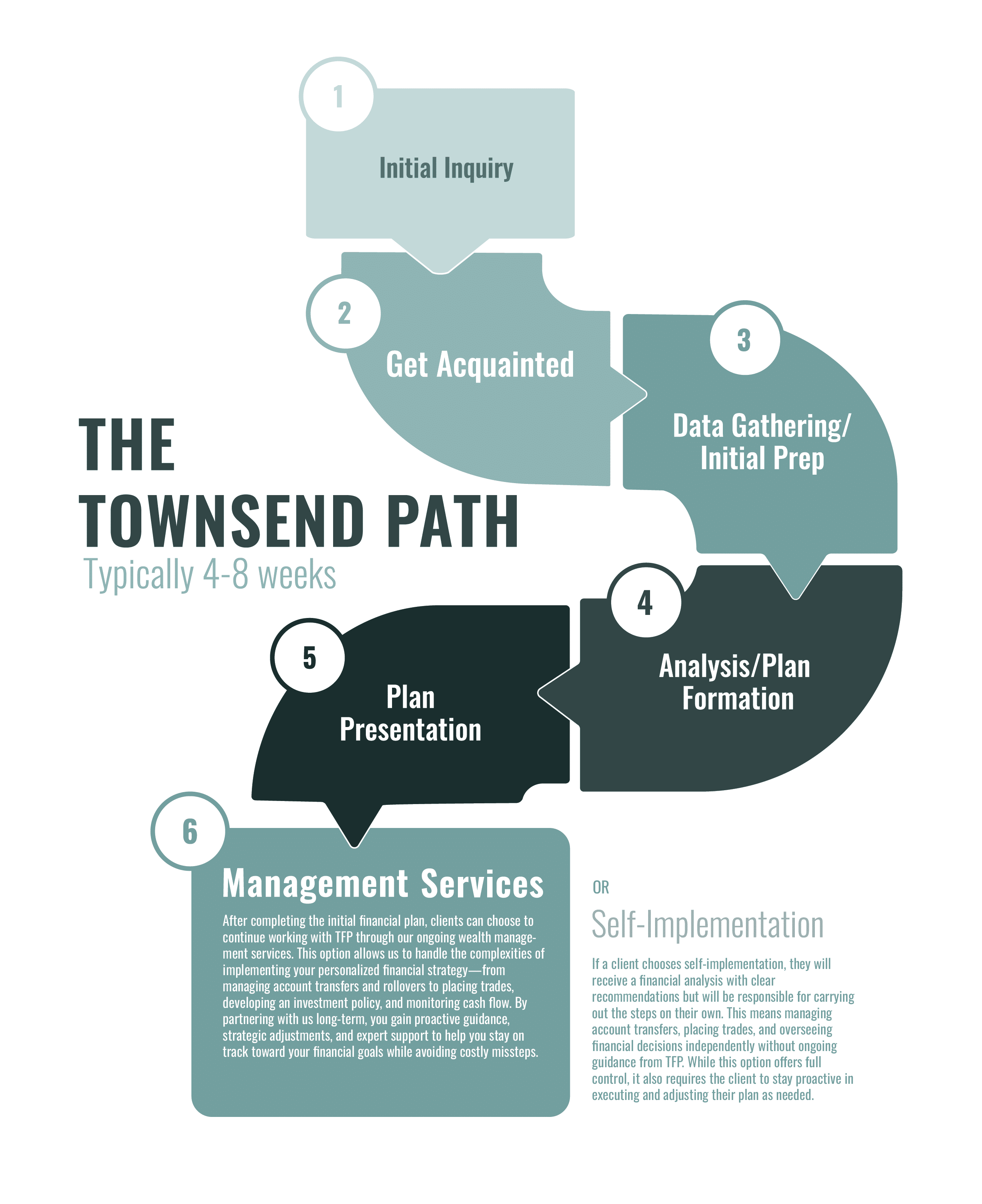

The Client Engagement Process

We will meet to review your financial planning report, present our personalized recommendations, and discuss any questions you may have.

STEP 1:

Initial Inquiry

OUR RESPONSIBILITIES:

Provide a brief overview of TFP’s services, philosophies, methodology, and fee structure.

YOUR RESPONSIBILITIES:

If interested, schedule a complimentary Get Acquainted Meeting (in person, via videoconference, or by phone) and complete the Confidential Questionnaire provided by TFP.

STEP 2:

Get Acquainted Meeting

OUR RESPONSIBILITIES:

Engage in a discussion to understand your needs and objectives, determine the suitability of our services, and provide an estimated cost.

YOUR RESPONSIBILITIES:

Decide to engage TFP’s services and provide additional requested information to initiate the development of your personalized financial plan.

STEP 3:

Data Gathering and Initial Prep

OUR RESPONSIBILITIES:

Review the information provided and begin developing your custom financial plan, preparing initial reports.

YOUR RESPONSIBILITIES:

Gather and submit the requested data, including completing a Risk Tolerance Questionnaire, if provided.

STEP 4:

Analysis & Plan Formulation

OUR RESPONSIBILITIES:

Analyze the information, study various plan scenarios, and prepare final reports with observations, assumptions, specific recommendations, and an action plan tailored to your situation.

YOUR RESPONSIBILITIES:

Await the next meeting to review the developed financial plan.

STEP 5:

Plan Presentation

OUR RESPONSIBILITIES:

Present your personalized financial analysis/plan, detailing specific recommendations and addressing any questions you may have.

YOUR RESPONSIBILITIES:

Review the plan, ask questions, and consider the recommendations provided.

STEP 6a:

Choose Your Path -

Management Services

OUR RESPONSIBILITIES:

Assist with implementing the personalized recommendations, including account transfers and rollovers, placing trades, developing an investment policy statement, and daily cash monitoring.

Provide ongoing wealth management services, proactively strategizing and optimizing efforts to achieve your financial goals while helping you avoid costly missteps.

YOUR RESPONSIBILITIES:

Collaborate with TFP in the implementation process, providing necessary authorizations and information.

Engage in regular communication with TFP to review progress and make adjustments as needed.

STEP 6b:

Choose Your Path -

Self-Implementation

Management Services:

Deliver a comprehensive financial plan with detailed recommendations for you to implement independently.

Self-Implementation:

Take full responsibility for implementing the recommendations provided in the financial plan. This means managing account transfers, placing trades, and overseeing financial decisions.

Manage your financial plan independently after the presentation meeting without ongoing assistance from TFP.